Here is your access to our entire 2025 Trends Toolkit, which has incredibly eye opening videos, articles and reports.

The toolkit contains:

Hear from industry expert and Neal Bawa, The Madscientist of Multifamily, on what to expect in the economy and real estate market in 2025. Neal will give you his take on macroeconomic trends that are shaking the real estate industry to its core.

Interesting videos covering key real estate topics – CNBC, CBS, Yahoo Finance, Bloomberg and more.

Reports on the impact of tax reform on real estate, national and CA housing affordability, Investment Outlooks and more.

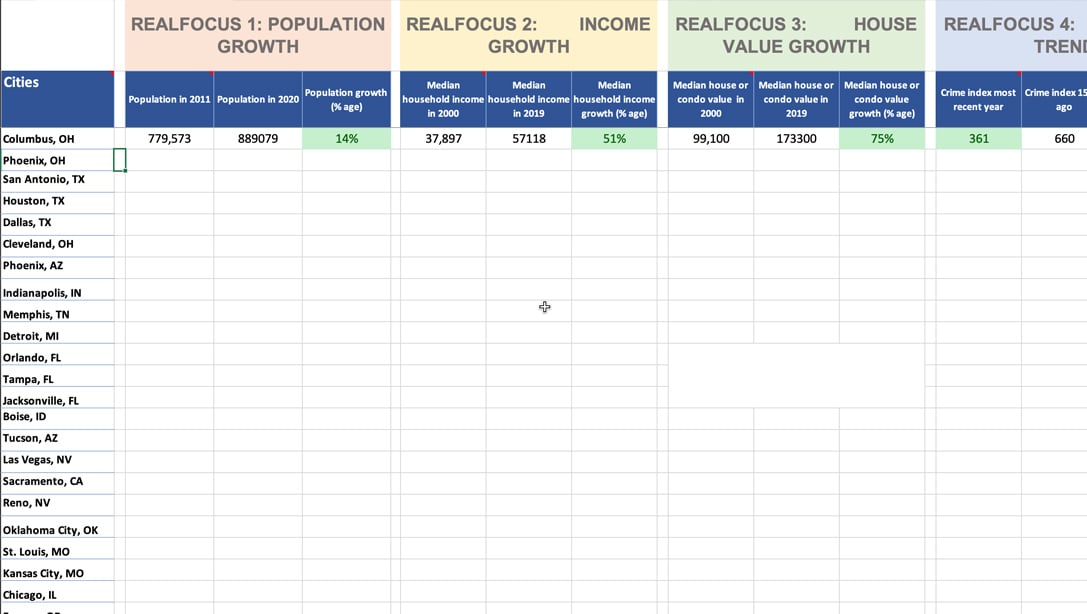

City comparison worksheet and Cities REALFOCUS 1-5 used for Udemy and Location Magic Students.

Detailed market ranking reports from ATTOM, Forbes, Realtor.com, Trulia, Zillow, Apartment List and more.

Articles covering the latest housing trends from changing millennial tastes to U.S. foreign investment.

Check out my top webinars, and invitations to in-person events where you can learn a LOT more about real estate investment.

Listen to Neal and Anna’s engaging real estate content, jam-packed with “aha” moments.

Connect via immersion and sharing with a like-minded group of individuals.

2025 REAL ESTATE TRENDS WITH NEAL BAWA

2025 Mid-Year Real Estate Trends

Neal Bawa, known as the “Mad Scientist of Multifamily,” delivered his highly anticipated 2025 Mid-Year Real Estate Trends webinar to a packed virtual audience. Backed by deep data and macroeconomic insight, Neal broke down what’s happening in real estate—and what’s coming next.

With inflation cooling, interest rates stabilizing, and political uncertainty on the rise, Neal focused on helping investors see beyond the noise and find high-probability opportunities across asset classes.

FORBES:

Experts Predict How Much Mortgage Rates Will Drop

All copyrights belong to Forbes.

To access this report directly, please click here

All copyrights belong to Bloomberg.

To access this report directly, please click here

All copyrights belong to Berkadia.

To access this report directly, please click here

All copyrights to this report belong to Newsweek. To access their research, click here

THE MORTGAGE REPORTS:

Will Interest Rates Go Down in October? | Predictions 2025

All copyrights belong to The Mortgage Reports.

To access this article, clicks here

All copyrights to this report belong to Newsweek. To access article, click here

All copyrights belong to RealPage.

To access this article, click here

All copyrights belong to Yahoo Finance.

To access this article, click here

All copyrights belong to Fast Company.

To access this article, clicks here

All copyrights belong to Yahoo Finance.

To access this article, clicks here

All copyrights belong to CNN Business

To access this article, clicks here

All copyrights belong to Newsweek..

To access this article, clicks here

WATCH SOME OF THE EXPERTS ON THE SUBJECT TALK ABOUT THE IMPACT OF INTEREST RATES ON REAL ESTATE

What lower mortgage rates mean for the housing market

US faces housing affordability ‘crisis’ amid market concerns, expert warns

Why the housing crisis won’t end anytime soon

REAL ESTATE TRENDS VIDEOS

Marcus & Millichap:

The Forces Driving Interest Rates Lower – Will They Last?

All copyrights to this video belong to Marcus & Millichap.

To access more content, please click here

CNBC:

Housing affordability is the most stretched since the early 1980s

All copyrights to this video belong to CNBC

To access more content, please click here

YAHOO FINANCE:

Real estate investors are swooping in to buy homes

All copyrights to this video belong to YAHOO FINANCE.

To access their YouTube channel for more content, please click here

Marcus & Millichap:

The Fed Cut Rates — Now What?

All copyrights to this video belong to Marcus & Millichap.

To access his YouTube channel for more content, please click here

YAHOO FINANCE:

Fed cuts interest rates: Is it a good time to buy a home?

CNBC:

UBS’ John Lovallo: Housing market bottom in sight as builders stabilize

All copyrights to this video belong to Fox Business.

To access for more content, please click here

U.S. Outlook and Impact Reports

LASALLE US Real Estate Outlook

All copyrights to this report belong to LaSalle.

To access their research, click here

CBRE U.S. Real Estate Market Outlook 2025

All copyrights to this report belong to CBRE.

To access this research directly, click here

MORGAN STANLEY 2025 Real Estate Mid-Year Outlook

All copyrights belong to Morgan Stanley.

To access their research, click here

YARDI MATRIX National Multifamily Report – August 2025

All report copyrights belong to Yardi Matrix.

To access this research directly, click here

Resources for Udemy and Location Magic Students

City Comparison

Location Magic Spreadsheet

RealFocus Cheatsheet for Cities:

Rules for 2025

TRENDS ARTICLES

All copyrights to these articles belong to the organizations indicated below.

To access each article directly, please click on the individual links.

RANKING REPORTS & ARTICLES

Featured reportS

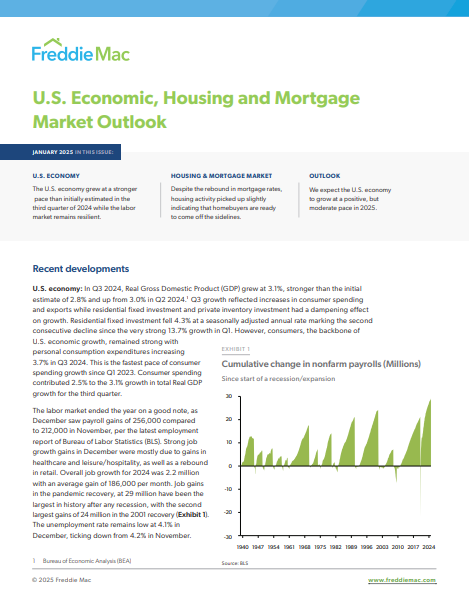

All copyrights to this report belong to FreddieMac.

To access this research directly, click here

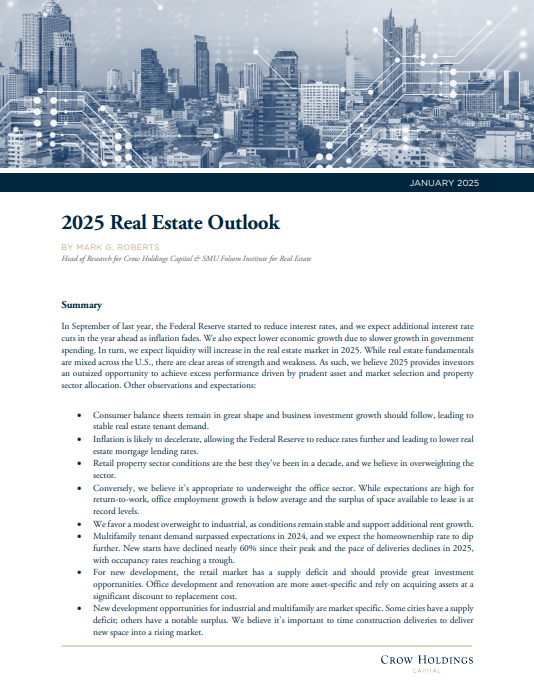

All copyrights to this report belong to Crow Holdings.

To access this research directly, click here

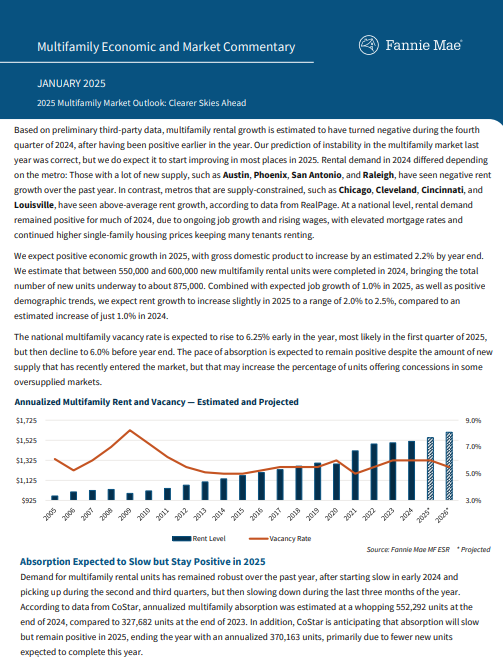

All copyrights to this report belong to Fannie Mae.

To access this research directly, click here

All copyrights to these articles belong to the organizations indicated below.

To access each article directly, please click on the individual links.

Webinars & In Person Events

Featured Webinars

WEBINAR REPLAY

Neal Bawa's 2026 Real Estate Trends

WEBINAR REPLAY

Neal Bawa’s Location Magic: How to Find the Hottest Real Estate Markets

WEBINAR REPLAY

The AI Revolution: AI-Fueled Data Centers as the Real Estate Play of the Decade

WEBINAR REPLAY

Chaos to Cash Flow: The Ultimate Guide to Creating Passive Income with Multifamily Investing

Additional Webinars

WEBINAR REPLAY

Is This Rock Bottom Data-Driven Insights and Analysis on the Commercial Real Estate Tipping Point

WEBINAR REPLAY

Bracing for the Storm: Navigating the Looming Crisis in Multifamily and Commercial Real Estate

WEBINAR REPLAY

The Ultimate Guide to Short-Term Rental Success Thriving in Today’s Real Estate Market

WEBINAR REPLAY

2025 Commercial Real Estate Lending Trends, Challenges, and Opportunities

PODCASTS

Neal Bawa Unplugged: Podcast Appearances

GET CONNECTED

Multifamily University

YouTube Channel

Subscribers

Views