Where should we send your Build-To-Rent - What is it and how can you profit webinar replay access information?

Privacy Policy: We hate spam and promise to keep your email address safe.

1600

Location Magic students

Community members in our Facebook groups

As an investor, taking advantage of diverse sectors is crucial to your success. In my next webinar I’m covering groundbreaking, never-before-covered content on an overlooked but booming sector that’s changing the U.S. real estate market.

This sector has:

Low maintenance

Strong demand

Turn-key properties

Long-term tenants (less tenant turnover)

Higher rent appreciation

What is this incredible real-estate sector, you ask?

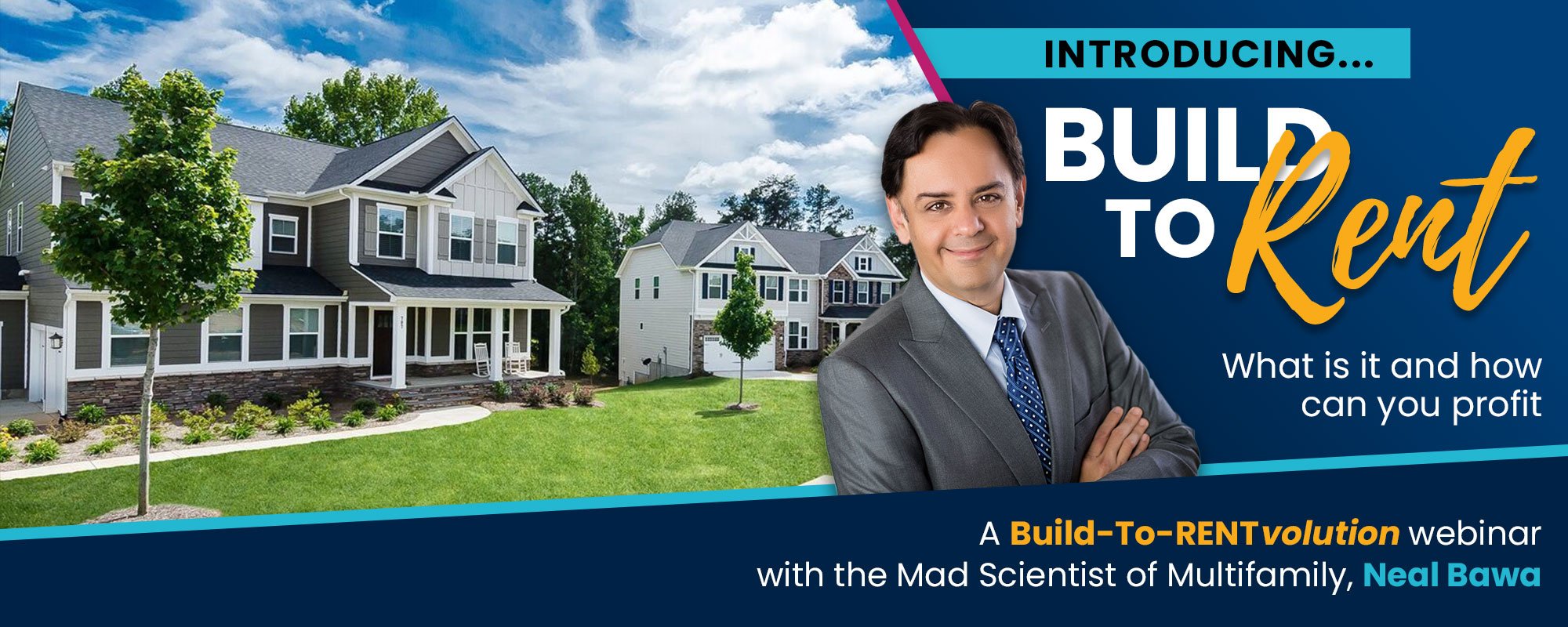

It’s the Build-To-Rent (or BTR) sector.

Also known as Horizontal Apartments, BTR properties are a cluster of freestanding rental homes.

BTR neighborhoods feel like gated communities, complete with high-end amenities and professional management, making them attractive to tenants and investors.

BTR properties have higher returns than apartments or condos and cost less to invest in.

Institutional investors and mid-sized portfolio owners are profiting from this sector. Now, you can too!

Real estate expert Neal Bawa will reveal how you can invest in this exploding sector with higher profits, and why NOW is a great time to capitalize from it!

Where should we send your Build-To-Rent - What is it and how can you profit webinar replay access information?

Privacy Policy: We hate spam and promise to keep your email address safe.

TAKE ADVANTAGE OF THIS EXPLODING REAL ESTATE SECTOR

Neal will teach you strategies he uses to successfully choose and invest in BTR properties for himself and how you can do it too!

HIGH DEMAND AND EASY ACCESS TO CAPITAL MAKES BTR PROPERTIES A LUCRATIVE INVESTMENT OPPORTUNITY

Neal will show you why high demand from millennials and families, easy access to capital, stable renters, and higher potential yields will maximize your profits using the BTR strategies.

EXIT STRATEGIES OF BTR PROPERTIES

Residential property investors who buy single-family BTR homes have more options for a quicker exit strategy when compared to a traditional home or apartment building.

WHAT YOU WILL LEARN IN THIS AMAZING FREE WEBINAR

WHY BTR PROPERTIES HAVE BROAD APPEAL – From seniors to singles and families, discover what attracts them to living in a BTR community.

WHAT’S DRIVING THE SHIFT TOWARD BTR – Neal will show you why this shift is happening and why NOW is the perfect time to take advantage of this incredible opportunity.

WHY 2021 IS WELL POSITIONED FOR SUCCESS IN BTR PROPERTIES – Neal will tell you why the pandemic, migration towards suburban communities and more make this the perfect choice to grow your investment portfolio in 2021.

HOW YOU CAN GET THE “UNFAIR ADVANTAGE” IN THIS REAL ESTATE SECTOR – Learn how to jump in on this amazing opportunity to grow your portfolio. Neal will show you various ways to successfully invest in this booming real estate sector.

Learn the best way to invest in high-quality, long-term BTR properties that are professionally managed with low risk and great returns.

Where should we send your Build-To-Rent - What is it and how can you profit webinar replay access information?

Privacy Policy: We hate spam and promise to keep your email address safe.

Meet Your Presenter and host

NEAL BAWA

Founder & CEO,

Grocapitus, Mission 10k & Multifamily University

Neal Bawa is a technologist who is universally known in the real estate circles as the Mad Scientist of Multifamily. Besides being one of the most in-demand speakers in commercial real estate, Neal is a data guru, a process freak, and an outsourcing expert. Neal treats his $660 million-dollar multifamily portfolio as an ongoing experiment in efficiency and optimization.

The Mad Scientist lives by two mantras. His first mantra is that, “We can only manage what we can measure”. His second mantra is that, “Data beats gut feel by a million miles“. These mantras and a dozen other disruptive beliefs drive profit for his 1000+ investors.

Where should we send your Build-To-Rent - What is it and how can you profit webinar replay access information?

Privacy Policy: We hate spam and promise to keep your email address safe.

Can’t attend the live webinar? Don’t worry! Just sign up so you will get the replay the day after the live presentation via email.

Where should we send your Build-To-Rent - What is it and how can you profit webinar replay access information?

Privacy Policy: We hate spam and promise to keep your email address safe.

Questions/Troubleshooting: info@multifamilyu.com

© Copyright 2025 | Multifamily University | All Rights Reserved